Bitcoin fell to its lowest levels since July 8 after Wall Street opened on Friday, with prices sliding and traders scrambling to reassess short-term plans.

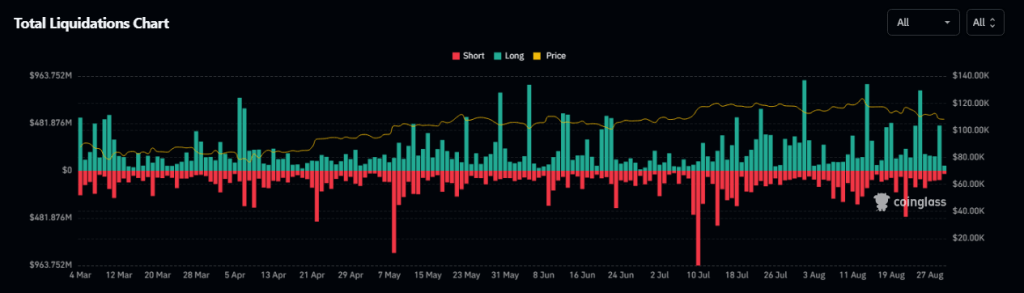

According to CoinGlass, 24-hour crypto liquidations neared $540 million as selling pressure intensified on major exchanges.

Related Reading

Whales And Exchange Distribution Pressure

Based on reports from market watchers, heavy selling by large holders helped push the drop. Distribution on Binance was highlighted by traders as a key factor that worsened losses.

Bitcoin lost nearly 5% on the day, and some large accounts were linked to the wave of sales that triggered stop orders and quick exits.

Popular trader Daan Crypto Trades pointed to a “key reversal zone” around recent ranges and consolidation levels.

Some experts had similar price levels on his radar, noting that Bitcoin failed to turn $112,000 into support. Other voices in the market flagged $114,000 as an important weekly close threshold for bulls.

Bullish RSI Divergence Keeps A Sliver Of Hope

Technical watchers found one bright spot. According to crypto commentator Javon Marks, the four-hour chart still shows a bullish RSI divergence — a pattern where the RSI makes higher lows while price makes lower lows. That setup can hint at an early reversal.

$BTC Good area to keep watching. Right on top of the previous range & consolidation area. https://t.co/WEaG2IF6nV pic.twitter.com/Y7RftSqDio

— Daan Crypto Trades (@DaanCrypto) August 29, 2025

Marks argued Bitcoin could stage a rebound. He suggested a move back toward $123,000 is possible, which would be roughly a +14% jump from current levels. That projection is optimistic, and it rests on momentum flipping quickly in favor of buyers.

Macro Data, Seasonal Weakness Add Headwinds

Seasonality and macroeconomic data added pressure. September has historically been one of Bitcoin’s weaker months, and investors were watching US inflation readings closely.

The Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures index, matched expectations and showed signs of an inflation rebound.

Still, the CME Group’s FedWatch Tool showed markets pricing in rate cuts in September, a factor that could help risk assets like crypto if it holds.

Related Reading

Range Bound For Now, Traders Watch $112,000–$114,000

Reports have disclosed that traders are focused on a narrow set of price markers. If Bitcoin can reclaim $112,000 and hold a weekly close above $114,000, bulls would gain breathing room.

If those levels fail, more downside is possible and short-term traders could face further liquidations.

For now, the market looks tight. Some technical signals point to a rebound, but macro data and big sellers are keeping the mood cautious.

Traders and investors alike are watching both price action and economic prints closely as the US heads toward key data and the Fed decision window on Sept. 17.

Featured image from Unsplash, chart from TradingView