- DeXe has a bullish long-term structure.

- The low trading volume and daily unlocks could be concerning to potential investors.

DeXe [DEXE] gained 18% from the 15th to the 22nd of April, and looked like it could challenge the $15.75 resistance and climb higher.

Yet, it saw a swift reversal on Wednesday, the 23rd of April, and most of the past week’s gains have been wiped out.

The governance token of the DeXe protocol witnessed a 0.02% unlock each day of its total supply of 96.5 million DEXE, according to CoinMarketCap data. This $300k supply was not much for a $1.13 billion asset.

Yet, its trading volume was quite small — the 50-day moving average of daily trading volume on Binance was 177k DEXE, worth $2.4 million. The same statistic on Binance for Ethereum [ETH], the leading altcoin, was 593.93k ETH, worth $1.04 billion.

DeXe signals buying opportunity

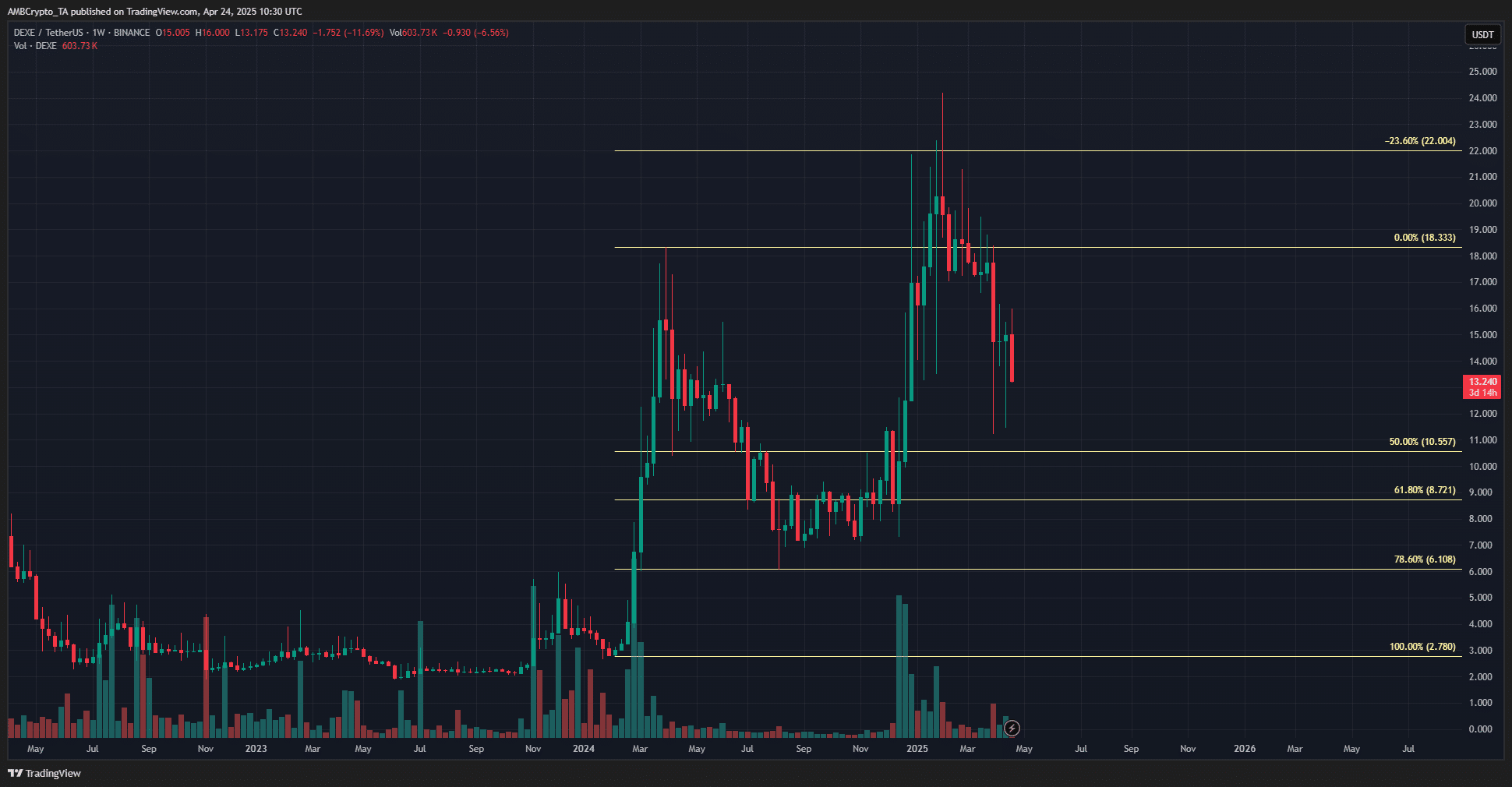

Source: DEXE/USDT on TradingView

The rally in early 2024 saw from $2.78 to $18.33, was a sign of bullish intent, breaking the bear market. It receded to the 78.6% retracement level at $6.1 before rallying to $24.2 in January 2025.

It was interesting that the 23.6% extension level at $22 offered some resistance to DeXe bulls in December and January. The token has been in a retracement phase since then, although it retained its long-term bullish structure.

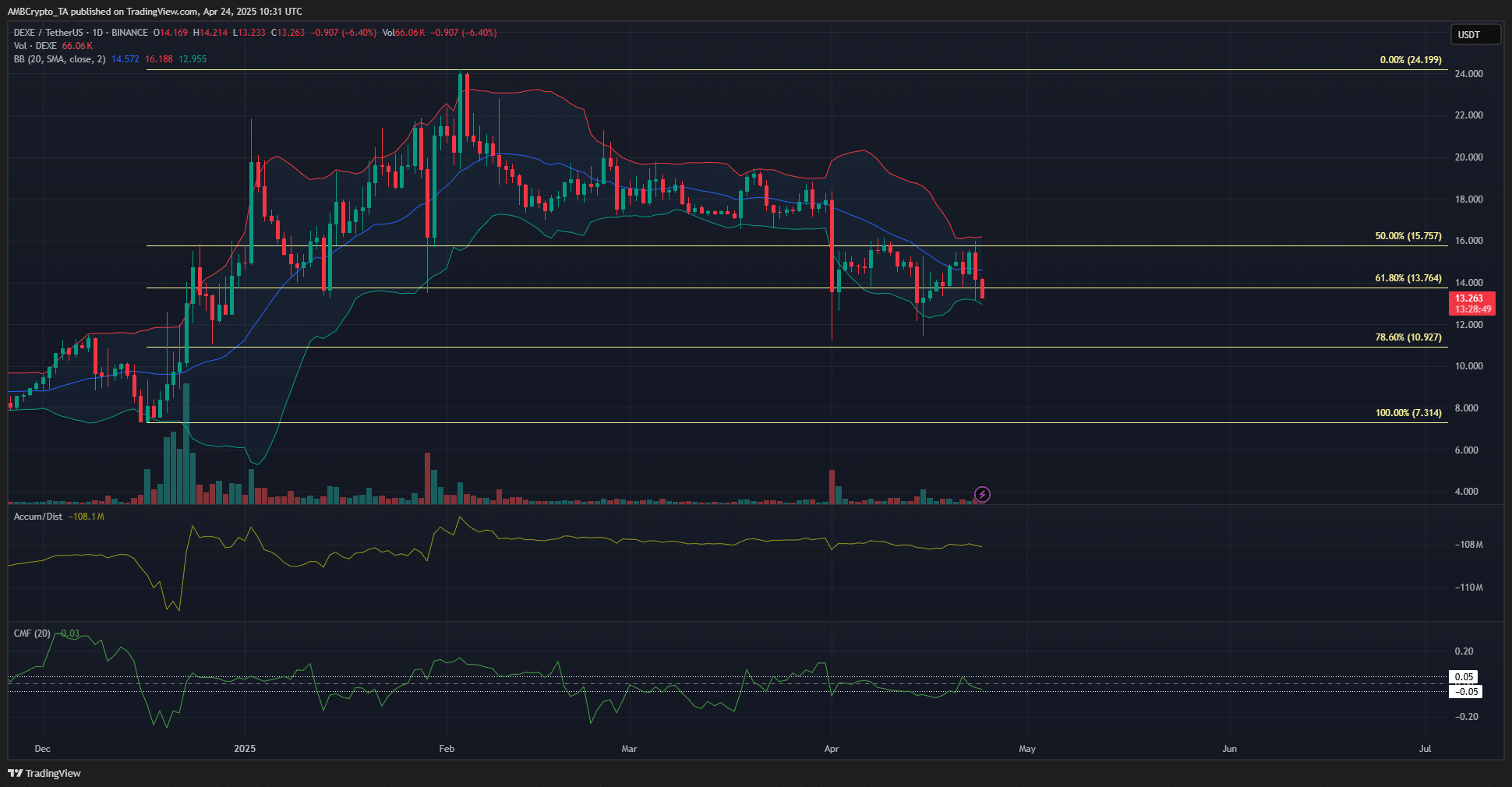

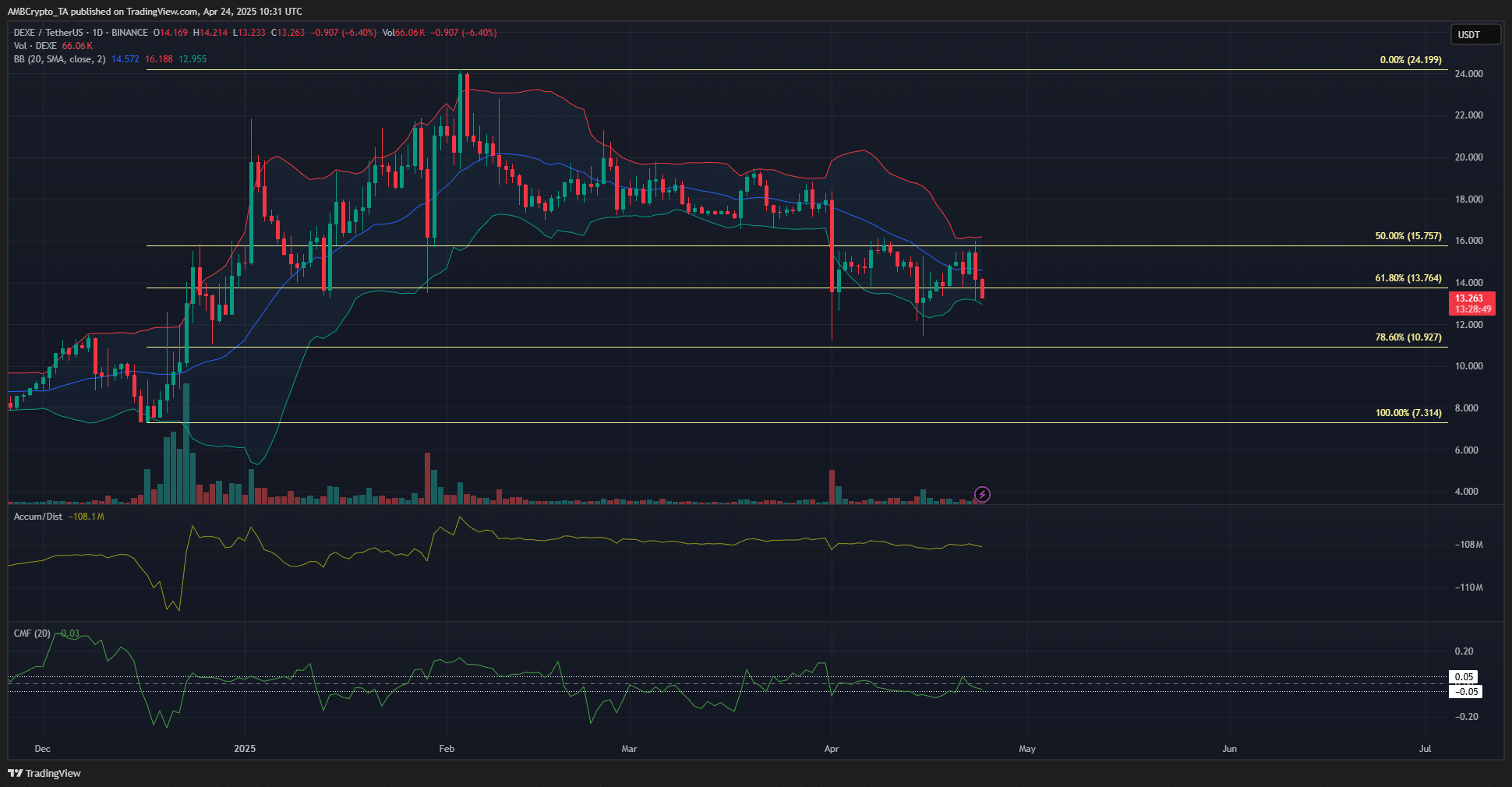

Source: DEXE/USDT on TradingView

The 1-day chart was used to plot another set of Fibonacci retracement levels of the rally toward the end of 2024.

It showed that the 78.6% level was at $10.92, and the DEXE prices nearly tested this level twice over the past month.

If history repeats itself, a retest of $10.92 as support would offer a good buying opportunity. The technical indicators on the daily chart did not show much bullishness due to the past six weeks’ price action.

The A/D indicator was in a slow downtrend, reflecting a lack of strong demand for DEXE. The CMF also struggled to clear the +0.05 level for two months, another sign of weakness from the buyers.

Overall, although a deeper DEXE dip would present a buying opportunity from a technical perspective, its low trading volume (exhibited by the 50DMA) was a concern. Buyers should exercise caution.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion