There’s no analyst consensus for the Bitcoin price outlook for 2026.

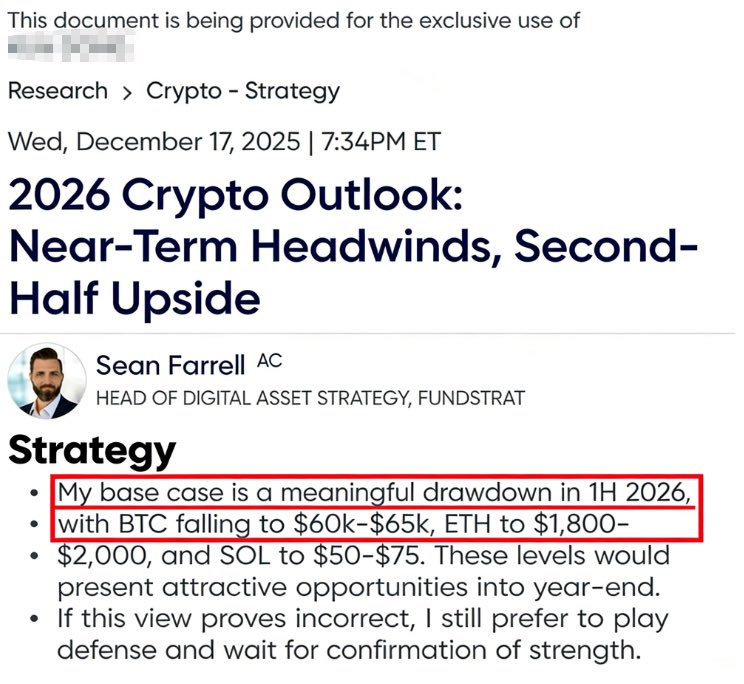

In a recent client memo, Fundstrat warned of choppy markets and a potential BTC dip toward the $60K–$65K zone.

Fundstrat’s Crypto Strategy Head Sean Farrell said ETF inflow exhaustion and post-halving miner selling could pressure prices short term.

Source: Fundstrat

This was contrary to the fund’s head of research, Tom Lee’s public call for a new all-time high of $200K by early January, sparking confusion and community backlash.

But Fundstrat was not the only bear in early 2026.

Bitcoin’s mixed 2026 outlook

Galaxy’s head of firmwide research, Alex Thorn, viewed 2026 as “too chaotic to predict.” He added that a new ATH high was “still possible,” but the uncertainty was high ahead of elections.

“Options markets are currently pricing about equal odds of $70k or $130k for month-end June 2026, and equal odds of $50k or $250k by year-end 2026. These wide ranges reflect uncertainty about the near term.”

However, Thorn was confident of a $250K by 2027.

In contrast, Bitwise and Grayscale projected a new ATH in H1 2026, citing demand for safe havens and renewed ETF inflows.

For Thorn, the structure could reclaim bullish momentum only if BTC surges above $100K-$105K in the mid-term.

Near-term sideways structure

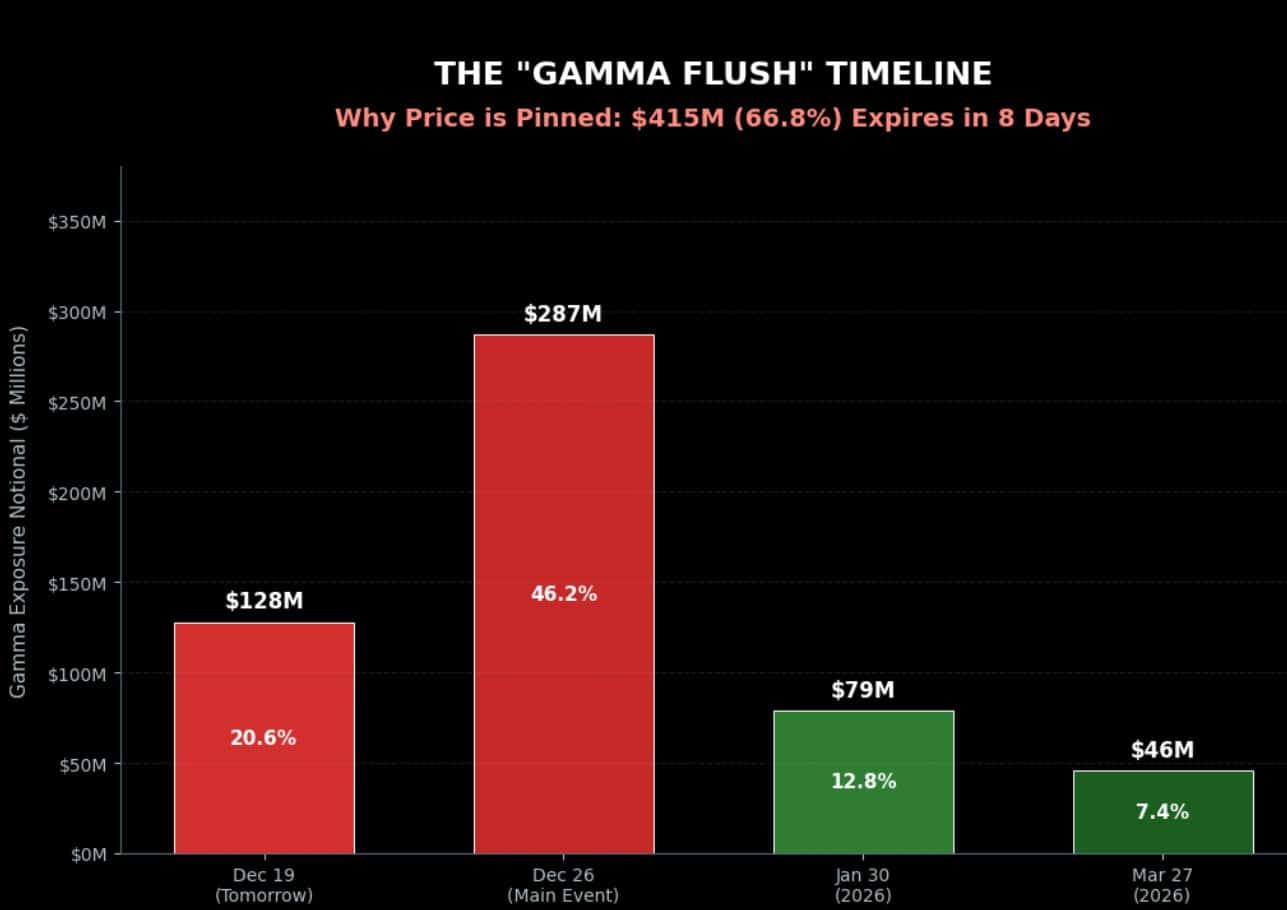

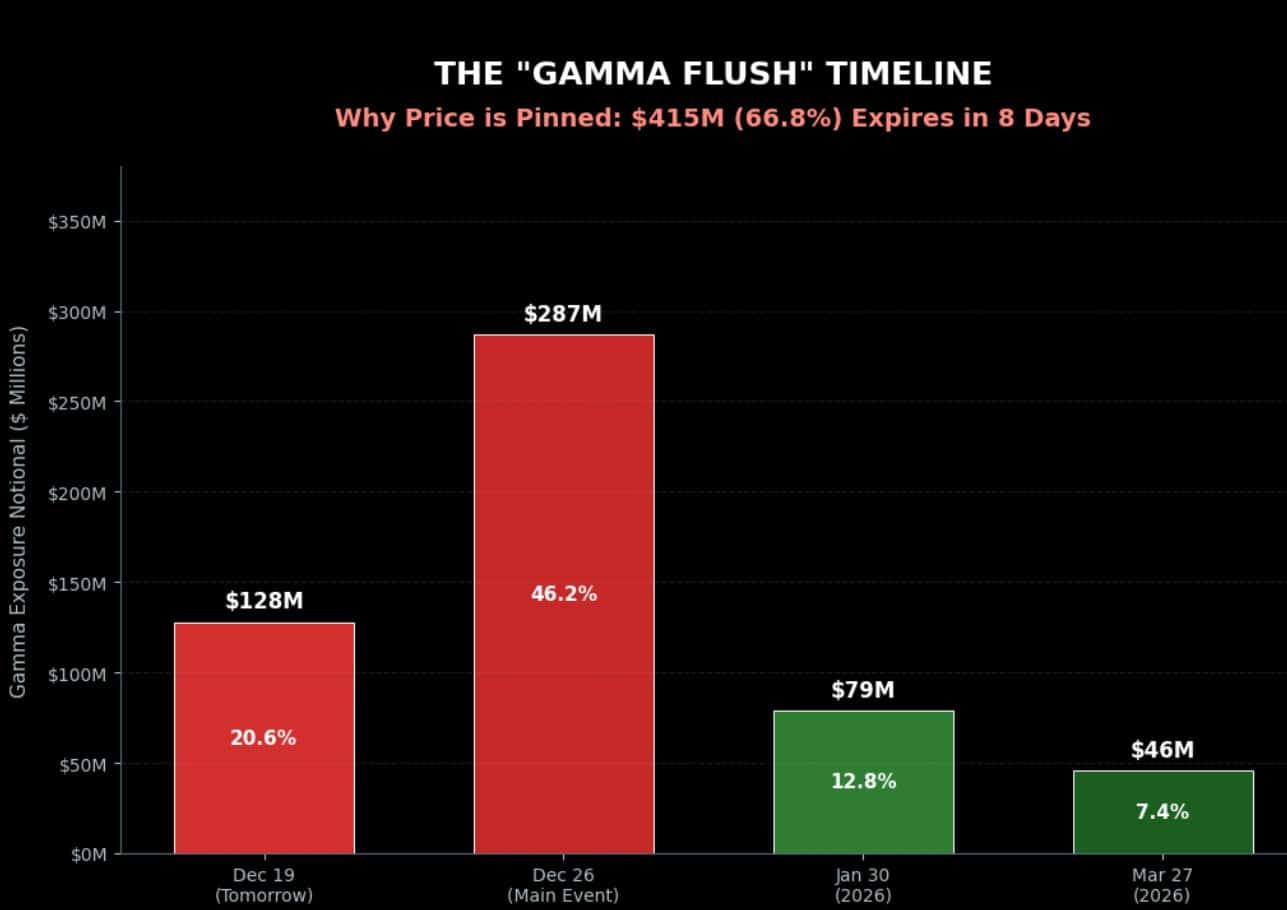

In the short term, however, analysts noted that the next Bitcoin direction could be set after Christmas Day. About $23 billion in Bitcoin [BTC] options are set to expire on the 26th of December, pointing to a likely volatile year-end.

According to analyst James Van Straten, top funds have been actively hedging around $85K-$90K and the expiry on the 26th of December will clear this wall (Gamma flush theory).

“Bitcoin will stay in the $85,000 to $90,000 range until options expiry. This could be beachball under the water and the catalyst that sends bitcoin back to $100k.”

Source: X

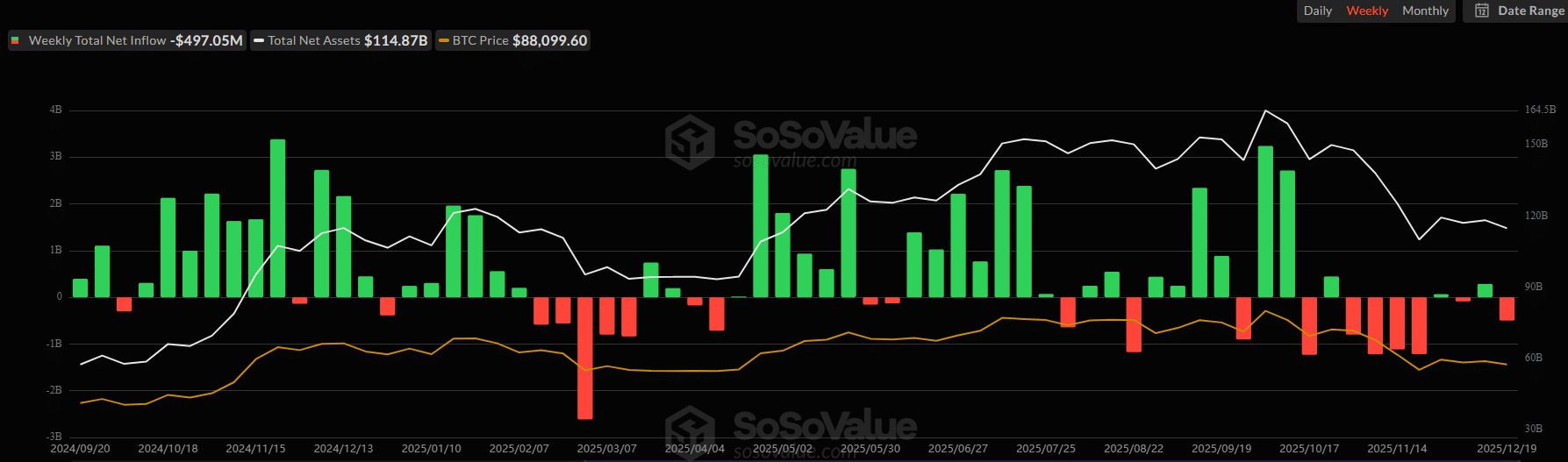

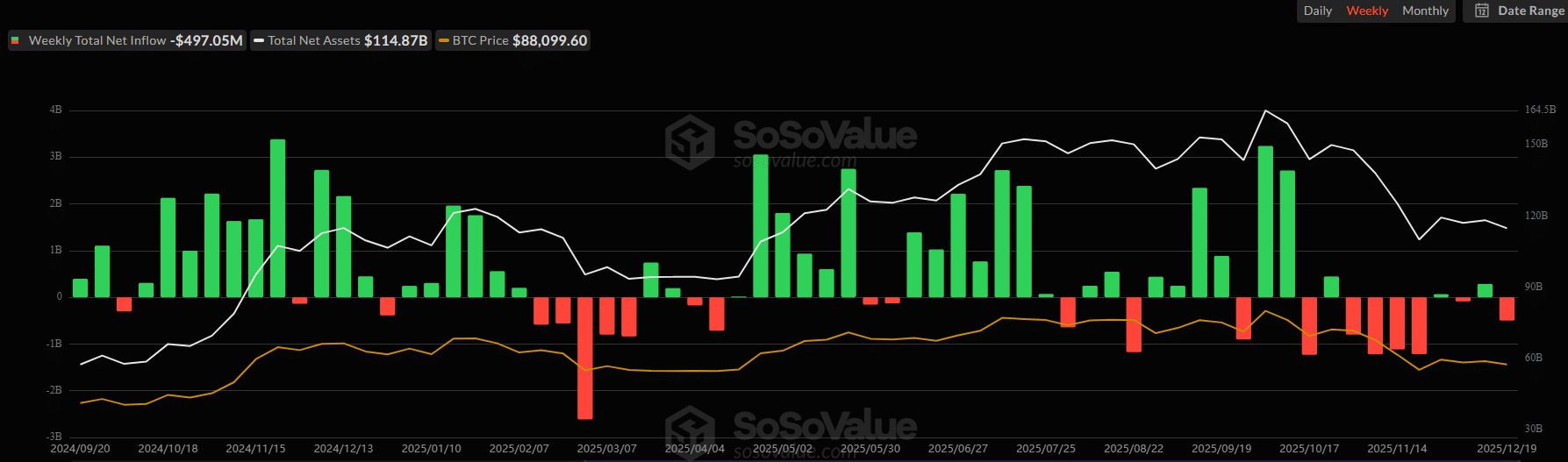

On the ETF front, last week, investors withdrew nearly $500 million from the products, underscoring the overall risk-off mode during the heavy macro updates.

However, there has been tepid ETF demand since October, which could further suppress prices at current levels.

Source: Soso Value

Final Thoughts

- Major funds and asset managers are split on BTC projections in 2026.

- Analysts expect the next near-term direction to be set after December 26.